Eliminate the silent "tax" on your income

Give customers choice in how they pay without increasing costs

Continuing to absorbing processing fees every time a customers pays can feel unfair. You shouldn't have to pay another “gross income tax” to get paid for the work you do.

Offer customers a card price and cash price for your goods & services

Card Price $104.00

You walk away with $100.00 exactly, and customers gain the convenience of paying with card plus all the reward benefits.

Cash Price $100.00

Who doesn't love cash?? For those who want the best price and are willing to pay you in person.

How it works 1…2…3…

Create an Invoice in Quickbooks

Just like you normally do!

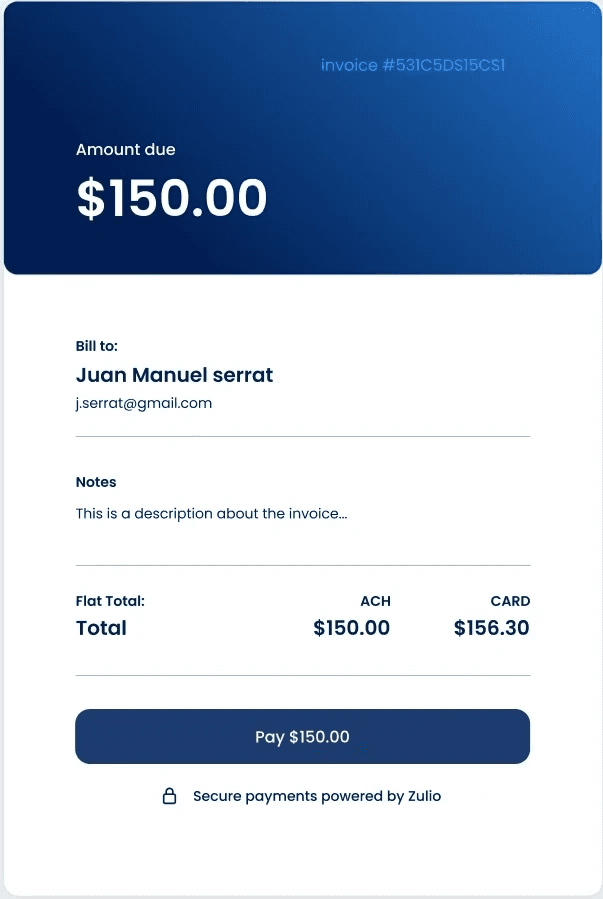

We will automatically send an invoice to your customer

Invoice will include all your line items, showing card & cash price

Once invoice is paid, it is marked paid in Quickbooks

…and deposit will match invoice amount perfectly. (to the penny)

Processing fees are costing your business more than you think!

This simple hack can increase net revenue 10% - 40%

Paying out a percentage of the revenue your business receives to processing companies, cuts directly into your net profit each month. As an example, If your business has a 30% profit margin, paying processing fees out of pocket is a 13% hit on your net profit!

Instant ACH*

*Coming Soon. Our advanced ACH platform enables customers to pay via ACH, while still providing next-day deposits.

Advanced Chargeback Protection

You shouldn't have to worry about chargebacks. We've built in advanced protections. making it harder for bad actors to win disputes.

Take Payments on the Go

Accept cash or card payments with our iPhone or Android app.

Send Invoices

Email customers an invoice they can conveniently pay online.

Manage Payments Online

Take payments and view transactions on our dashboard.

Chargeback Protection

Robust security measures that help prevent chargebacks.

Clean Reporting

Sales match deposits perfectly. No more confusing reporting.

No PCI Questionnaires

No annual PCI Compliance questionnaires and junk fees.

I'm on board!

How do I communicate this to my customers?

We have combined answers to the biggest objections and a step-by-step process to make implementing this program a success for your business!

Here are the facts. Based on a survey of over 100 merchants during their 1st month of implementing dual pricing, there was found NO noticeable difference in sales volume or loss of repeat customers.

99.2% of customers did not even comment or make a remark about a price difference.

99.9% of merchants had NO noticeable drop in sales during their first month of offering dual pricing.

99.9% of customers returned to do business with the merchant said the fact that the merchant offered dual pricing had no effect on their willingness to return in the future.

Our world is changing. Prices are going up, regulations and requirements for businesses are increasing, and profit margins are getting tighter and tighter. We’ve found 99.2% of customers will not bat an eye as this is becoming an increasingly common practice.

Explain due to increased expenses you still wanted to offer cash paying customers the lowest possible price, and instead of raising prices for everyone, opted to allow customers choice in how they pay by offering a card and cash option.

Every one of your customers has visited a fuel station in recent weeks and accepted a slightly higher price because they payed with card.

Jenna

"Super easy! Honestly, it works lightning fast and deposits match my sales totals every time!."

Michael

"Our experience with Zulio has been nothing short of exceptional. We were initially skeptical about the promise of a 20% increase in net revenue, but they not only met but exceeded our expectations."

Alex

"Incredibly lightweight and easy to use. I use it for my personal training business and saved a ton of money! well worth it!"

Miguel

"Our financial growth was stagnant, and we struggled to identify effective strategies for revenue enhancement. Zulio's innovative approach and dual pricing solution led to an 18% increase in our net revenue within just one fiscal quarter."